Tax Advantages of an LLC: An Introduction

Limited Liability Companies (LLCs) asset protection and LLC tax treatment are two bright spots in your business success. LLCs are powerful legal tools. The LLC tax advantages are significant. They have flexibility that just can’t be found in a corporation, and yet, they give you the same corporate shield for asset protection that a corporation does. They easily answer the question, “What entity should I use for my business, real estate investing, or family tax/estate planning?”

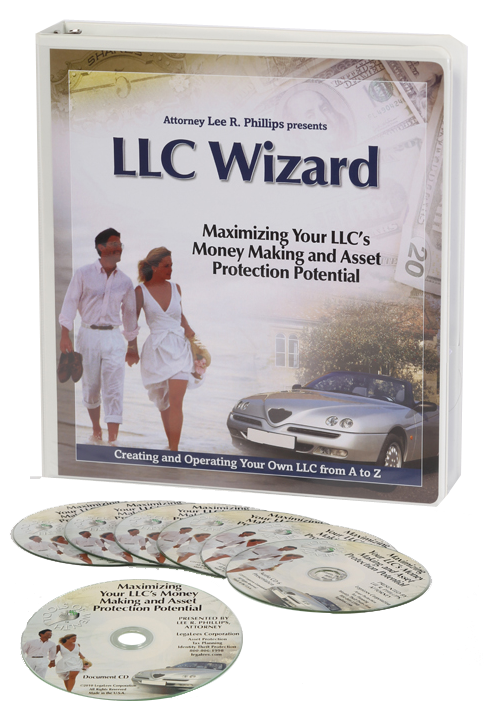

The LLC Wizard program is a comprehensive guide that gives you the ins and outs of establishing an LLC and maximizing its asset protection and tax advantages. Our brag isn’t that of the other internet sites: “It’s so easy. Just three computer clicks and you have an LLC.” In fact, our brag isn’t even that of the lawyers, who say, “Here’s your papers; sign here; and good luck.” You pay your hard earned bucks to the internet site or your lawyer, and magically you have your LLC. Neither the mouse-click nor the lawyers are always helping you build a strong foundation in forming an LLC.

Seriously, your LLC is your most important asset protection shield and tax shelter. If your LLC is protecting all of your assets from a business disaster and you could make an extra 20% in spendable income each year just by making sure your LLC is done properly and actually USED.

Isn’t it worth more than a click of your mouse and a “sign here” to make sure you get the benefits? If you’re working to get an extra 20% in your income this year, you’ll have to work an extra 75 days to make that additional 20% in take home money. Even if you spend a full day a year “taking care of your LLC,” wouldn’t it be worth it?

The LLC Wizard: Maximizing Your LLC’s Money Making and Asset Protection Potential System is designed to take you way beyond the other sites and even what your attorney does for you. The LLC Wizard System will get you all the way to your goal of great asset protection and more money.

Historical Overview of the Limited Liability Company (LLC)

Your lawyer may have told you that you didn’t want an LLC, because it’s “new” and it hasn’t been tested in the courts. What he is really saying is “My word processor is set up for corporations, and that’s what I studied in law school.”

The fact is, most lawyers have never really studied LLCs. They don’t appreciate what powerful tools LLCs are and how they let you protect assets (personal assets and business assets) and make more money.

The Ltd. and GmbH (Gesellschaft mit beschränkter Haftung) are old European versions of limited liability companies. The US did not invent LLCs. In 1977 legislation was passed in Wyoming to allow people in that state to use a limited liability company structure, essentially like the European Ltd. and GmhB. It is true, nobody knew how the courts, especially the courts in other states, would treat the new Wyoming LLC. It was for sure the people who set up LLCs didn’t know how the IRS would treat them.

Since 1977, those issues have almost totally been resolved. The Revised Uniform Limited Liability Company Act was passed in 2006. It refined the 1999 Uniform Limited Liability Company Act. With the revised uniform act in place, the law of LLCs is pretty much the same in every state.

There are little nuances in each state. For example, an LLC is very expensive in New York, because the person wishing to establish an LLC has to publish their intent in each of the main papers. That costs thousands of dollars. (The New York newspapers are obviously in bed with the New York politicians, or they have pictures of the politicians in bed with somebody else.)

The LLC Wizard gives you the ability to file your LLC in any state you want. You don’t need to go to Nevada or Delaware. (We’ll discuss those issues later.)

With the uniform laws, it is pretty certain how the courts in each state will treat an LLC. Having said that, you need to know that the “lunch theory of justice,” as I coined the term in law school, is alive and well. There is always the case that throws the law out the window and hinges on what the judge and the jury eats for lunch. But, the LLC will probably give you your best shot at protecting your assets. LLCs are well established and safe to use.

Using an LLC to Protect Your Assets

Your assets include all your personal assets and your business assets. Most attorneys and all of the LegalDoom websites focus on protecting your personal assets from disasters in the business. The LLC Wizard System goes deep into how to protect your business assets from personal disasters, such as illness, death, divorce, personal lawsuits, and taxes.

LLC and Taxes

The issues surrounding LLC tax treatment are now set in cement. The IRS has defined what they want and how they want it. That doesn’t mean the tax rates won’t change and new taxes will be passed. But, LLC taxation as it relates to the establishment of a taxing structure for LLC taxation is well established.

LLC Tax Classification

When the laws of limited partnerships and corporations were introduced way back in US legal history, the IRS wrote specific laws to govern how they would tax those entities. When it was determined that the little guy needed corporate protection, but should have simple taxation (that’s an oxymoron), the IRS wrote special laws. The traditional taxation rules for corporations are found in Chapter C of the IRS Code book. The simplified rules for taxation of small business corporations are found in Subchapter S of the IRS Code book. Subchapter S rules are very similar to the taxation rules for a partnership. You might note that the legal documentation, structure, liability protection, maintenance, and other parts and pieces of a corporation are basically identical, whether the corporation is taxed under Chapter C or Subchapter S of the IRS Code. A corporation is a corporation, independent of how it is taxed.

In 1977 when Wyoming passed laws describing the LLC business structure, they went to the IRS and asked them to write new laws for LLC taxation. How was the new LLC animal going to be taxed? In typical IRS fashion, they didn’t know what to do. It took until 1999 for the IRS to make up their mind on LLC taxation. Yes, thousands of LLCs were created between 1977 and 1999, and they filed taxes basically pretending they were corporations or partnerships. We just had to wait for new laws on LLC taxation. Finally, the IRS issued a ruling stating that the IRS wasn’t going to create new LLC taxation rules. The owner of the LLC could simply choose how their LLC taxes would be handled. LLC taxation became a “check the box” issue.

IRS LLC Tax

Your LLC could be invisible to the IRS if it has only one owner (member). In fact, it can be so invisible to the IRS, the IRS will call it a “disregarded entity.” You can choose to have your LLC taxed as a partnership or a corporation under either S or C. It doesn’t matter what LLC taxation structure you choose. Your LLC is still an LLC. It gives you the same asset protection no matter what LLC taxation structure you choose.

Your choice of LLC taxation will be made by filing forms with the IRS. The third module in the LLC Wizard System walks you through LLC taxation and which forms to file in order to make your choice. In fact, it walks you through LLC taxation down to how to fill out the forms one line at a time. Yes, the IRS has instructions for each of the LLC taxation forms, but wading through the IRS instructions isn’t always easy. The LLC Wizard gives you almost an hour of discussion as to which LLC taxation choice you should make and then how to qualify the LLC accordingly and fill out the necessary IRS LLC taxation forms.

LLC Wizard discusses the LLC taxation options for you in some detail. There are lots of factors that go into making a decision as to how you should tax your LLC. The LLC taxation decision isn’t just a knee jerk reaction. There are plusses and minuses for each LLC taxation decision.

LLC Tax Return

Often the LegalDoom websites or the attorneys will fill out the SS4 form for you and will get your LLC a tax ID number. That often leads to disaster, because once the SS4 is filed, that starts the clock on the other decisions you have to make. It also requires you to start filing income tax returns for your LLC, whether or not you’re making any money. In fact, if you don’t file the income tax returns there are heavy fines.

We see a lot of new LLCs that have lost their tax choice opportunity, because the SS4 was filed, and then the owner of the LLC didn’t even know there was a ton more they had to do with the IRS to establish the LLC taxation structure they wanted. For example, is your LLC taxation structure going to be an S corporation? If you don’t make your LLC taxation decisions timely, that’s an OOPS that often costs tens of thousands of dollars.

With the LLC taxation issues settled and the Revised Uniform Limited Liability Company act in place, use of an LLC is pretty well established. There are many issues that still need to be considered. None of the issues are hard to address, but they aren’t just “givens” when you are considering forming an LLC.

The LLC Wizard System has all of the written documentation you need to set up and file your limited liability company articles of organization in any state you want. It walks you through how to make the LLC tax decisions, how to fill out (line-by-line) each tax form, and how to set up your limited liability company operating agreement. The decisions you make in writing your limited liability company operating agreement will determine how good your limited liability company’s asset protection will be, what tax advantages you can get, how your LLC will survive your death, and a lot more.

How you maintain your LLC, the tax advantages you can potentially achieve, how much more money you can make, how your LLC will survive a divorce or other personal legal/financial disaster, how you can cut LLC fees, and many more issues all have to be addressed. LLC Wizard has 6 modules of text and audio instruction that addresses all of these issues in detail. Our website LLCWizard.com has a lot more discussion pages. Check them out and order the full LLC Wizard System now. It will get you all the way to more money and better asset protection. I’ll guarantee no other web site will get you there and your attorney most likely won’t get you there either.

Order the LLC Wizard Complete Guide to Starting Your LLC

Maximize your LLC’s money making potential and asset protection potential by learning how to properly set up your LLC.

Item includes:

- Complete guide to set up your LLC

- 9 audio CDs

FREE SHIPPING!